The question of government intervention in the economy and business has long occupied American economists, businessmen, and lawmakers. Does the government have a duty to ensure the competitiveness of American firms? Does national security trump wealth and free trade? Since the 1980s, messages based on individual liberty and prosperity have established that businesses were better off on their own and that the best way to incentivize competition was for the government to stay away from the private sector.

Today, however, the United States is considering a much different worldview. The COVID-induced supply chain crisis, combined with preceding global economic trends, has opened a substantive debate about how vulnerable the American economy is and how much it needs to be protected from foreign risk. Industrial policy, defined by the Carnegie Endowment for International Peace as “government intervention in a specific sector designed to boost the growth prospects of that sector and to promote the development of the wider economy,” has stepped in as a controversial alternative. [1] This intervention can be seen in the form of large government subsidies, tax breaks, and tariff or non-tariff barriers to foreign competitors.

In the second half of the last century, Japan used all of these tools to protect and promote its industrial base, especially car manufacturers. [2] By assisting their own firms and limiting the newcomers’ prices and strategies, they ensured the successful growth of their automotive industry, securing the Japanese market as a long-term customer but also ensuring prices were low enough to be highly competitive in foreign markets. This amount of protection, combined with the companies’ cleverness and vision, has led to the highly successful Toyota, Honda, and Suzuki cars that have made Japan the world’s second-largest exporter of motor vehicles. [3]

One must recognize, however, that there is no consensus on this issue, not even on the broad definition of industrial policy, which creates questions about when government intervention in the economy follows a strategic purpose or not. The United States has faced suboptimal decisions and downturns following this path, namely with General Motors and the auto industry. [4] In 2008, the United States had to rescue these “national champion hopefuls” due to their large employment numbers with $62.4 billion through the Troubled Asset Relief Program, and it spent an additional $8 billion to ensure the Chrysler and General Motors would not fall into bankruptcy. [5] Critics of industrial policy are right to point out that if done wrong, these policies can create a false sense of security in companies and hamper innovation, which leads to further bailouts and government spending that fails to keep the country’s competitive edge in a specific industry. [6]

What Policymakers Can Learn From Alexander Hamilton

To best address this debate, one must consider the perspective of the first U.S. Secretary of the Treasury Alexander Hamilton who in his Report on Manufactures stated that to generate “the desirable changes as early as may be expedient,” industries needed “the incitement and patronage of government.” [7] Brookings Institution scholars Jessica Lee and Bruce Katz explain that Hamilton, in an argument targeted at protecting nascent industries and new companies, outlined fear of failure as the “most serious impediment” to entrepreneurship and innovation which, in his opinion, would impede a country from reaching a leading status in any industry. [8] To placate this fear, Hamilton suggested that the federal government provide a support system for these new industries and companies, allowing them to grow out of their “infancy” with higher chances of being successful. [9]

At the time, such a philosophy found its expression in protectionist measures such as high tariffs, which shielded the American market from its foreign competitors. America then, however, had a non-existent industrial base, no experience in manufacturing, and an alarmingly small business network. Additionally, the Republic had just liberated itself from the world’s leading economy, the British Empire, which meant that the existing commercial networks and shipping routes were generally unfriendly to U.S. interests. [10] America today, however, is the world’s largest economy by GDP; the largest outbound Foreign Direct Investment investor; and the creator of the current economic order, shipping routes, and the international financial industry. [11]

This difference in context means that the specific tools proposed by Hamilton such as tariffs may no longer be viable, but the spirit that inspired these policies might. How could Hamilton in the 1790s have imagined that the production of a single engine would stem from more than five countries, with none of them being the company’s home nation? Or that the belligerent European countries would now be united under one flag and in a single market and currency? Tariff wars and barriers now limit the reach of the U.S. dollar and American investments, which hurts the economy. Keeping a competitive edge and advancing the interests of U.S. industry and companies will ensure the security and prosperity of the Republic. U.S. President Joe Biden has been acting precisely under that assumption, levying export controls on semiconductors, screening foreign investments coming from strategic rivals, bringing critical minerals production back to the United States and its allies, blacklisting certain companies such as Huawei, and issuing massive subsidies to specific industries and firms through the Inflation Reduction Act.

Advantages

One of the main factors that led to an American victory in the Cold War was the Union of Soviet Socialist Republics’s (USSR) inability to match U.S. levels of innovation and the efficiency of research and development (R&D) allocations, with repeated failed attempts to spur innovation in the communist country. [12] Following the disintegration of the USSR in 1991, the United States led the world in the growth and expansion of multilateral institutions focused on advancing economic and trade rules friendly to U.S. interests. Not only did pre-existing institutions like the World Trade Organization, the World Bank, and the International Monetary Fund open up the world’s markets to free trade and almost unlimited investment, but they also designed an unprecedented economic architecture that linked the world to the U.S. economy. This hegemonic position, as explained by Elbridge Colby in The Strategy of Denial, has now reached an end as the People’s Republic of China (PRC) challenges its status and creates parallel institutions reflecting its own political goals. [13]

The United States must realize, however, that this is not another Cold War, and the PRC is not the USSR. China is no longer the economy that manufactured the West’s cheap plastic toys; it has transformed itself into a technological and economic powerhouse. Cities like Shanghai and Shenzhen are global hubs for digital innovation, artificial intelligence start-ups, and much more, to the point of rivaling Silicon Valley. [14] The number of newly registered businesses in China rose from 95,000 in 2010 to 232,000 in 2020. [15] These companies have a number of unfair advantages, the first being the unparalleled governmental support of the world’s second-richest country, with almost unlimited subsidies and programs to ensure the success of domestic firms. [16] The second is the competitive environment, which is directly related to the PRC’s involvement in the private sector. In a survey conducted by the American Chamber of Commerce in China, nearly half of the 314 corporate respondents complained that in recent years local governments put them in a position of inferiority by taking away protection of their intellectual property rights while actively supporting Chinese-based companies. [17] It is thus neither suitable nor fair to ask American companies to compete with Chinese industry in the free market because, in the PRC, the free market does not exist. This survey clearly depicts how Hamilton’s understanding of the “fear of failure” still applies today and how we should expand its definition to include the danger of unfair competition keeping American industry from reaching its full potential.

These circumstances present significant risks to key industries, inspiring a conversation about decoupling from China to avoid the potential shutdown of critical U.S. supply chains. In addition to decoupling, a strong domestic industrial policy would enable the United States to harness the power of its ingenuity, innovation, and spirit of enterprise and pair them with the plentiful resources of the federal government. This is especially true for key industries such as semiconductors, which are critical to the healthy functioning of the U.S. economy. Over half of the world’s microchips are produced by TSMC (Taiwan Semiconductor Manufacturing Company), which experienced grave issues during the summer of 2020, creating a shortage of chips and destabilizing the world’s supply chains. [18] [19] U.S. President Joe Biden aimed to address this shortage with the CHIPS & Science Act, which provided massive subsidies and advantages to chipmakers in the United States. This move was paired with a number of industry-specific export controls that attempted to reduce the PRC’s ability to produce and export its chips to Western markets. It must be acknowledged that China still retains key chokeholds in the lines of chip production. This kind of policy, however, which in the future could tackle energy production or rare earth materials, is aimed at building resilience and protecting supply chains from harmful vulnerabilities.

It is also vital that the United States keep a competitive edge over historically advantageous industries in which China is trying to make a breakthrough. While policymakers can and must ensure that the United States dominates in the financial and technological services sectors, it is equally important that U.S. manufacturing operations remain on point and competitive, following Hamilton’s message in the Report on Manufactures. And while policymakers must avoid picking one company as the national champion (unless there are existing predominant firms in a market, such as Boeing in commercial aviation), the federal government can assist companies that meet specific criteria to make them more competitive against their rivals from the PRC.

Additionally, industrial policy can be a tool to bring allies together through “friend-shoring,” which is the friendly side of geoeconomics. This would entail moving production of specific items away from rival countries to strong allies such as Canada, the European Union (EU), Japan, or Australia, creating jobs and investment in those countries and improving relations with each. Separately, allies can work together to take a closer look at the resilience of their economies and identify weak spots or security threats together. It can also be a tool to harness the capabilities of new friends by moving that same production to countries with which the United States wishes to establish better relations, like Vietnam or India.

Disadvantages

There are, however, scholars urging against specific practices within industrial policy, mainly subsidy programs funding individual industries. First and foremost: can the United States afford this? Washington has been running on a stressed budget and large deficit for the last twenty-two years, leaving little liquidity available to create large subsidy programs. [20] [21] Debt levels are also through the roof, at a concerning 123.6 percent of GDP in September of last year. [22] Due to this problematic financial situation, there is no guarantee that policymakers could maintain a sustainable industrial policy, and even if they could, budgetary and debt-structuring policies are now victims of political grandstanding, making it increasingly difficult to choose an industry to support or craft a path to attain a competitive edge. Hamilton, though passionate about American competitiveness, faced the challenge of repaying the country’s debts after the Revolution, which he understood put the growth of the U.S. economy at risk. [23]

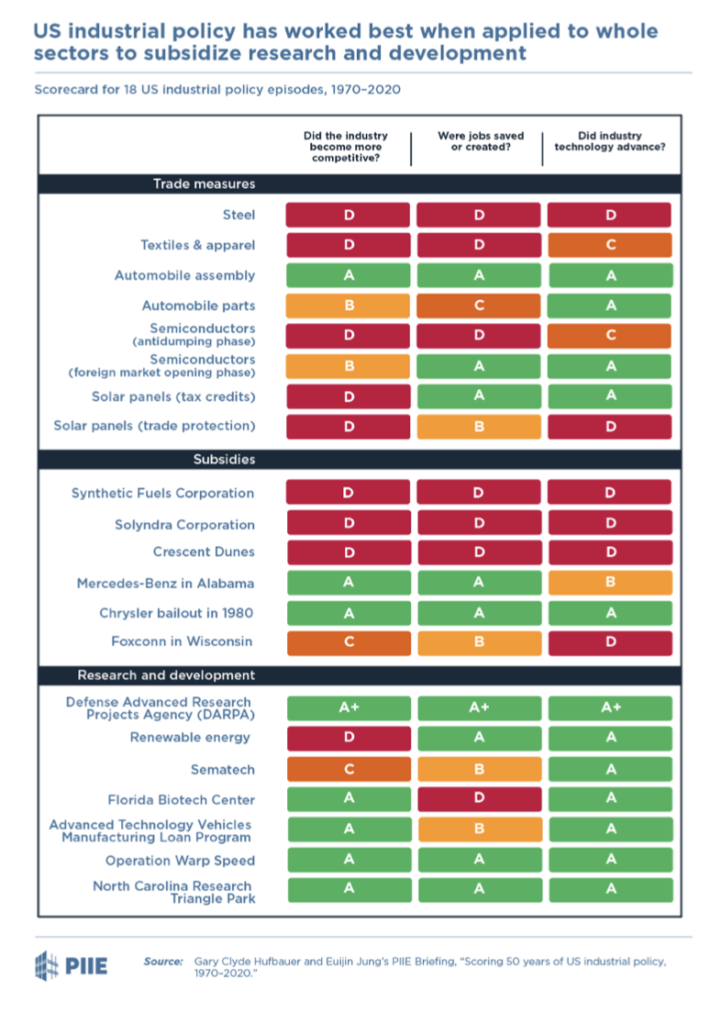

Additionally, subsidies do not necessarily translate into good performance. James Pethokoukis of the American Enterprise Institute states that while government intervention can make an industry more competitive, it is most efficient in the form of research and innovation support. [24] Making a similar argument, Gary Clyde Hufbauer and Euijin Jung from the Peterson Institute for International Economics (PIIE) compared 18 cases of industrial policies from 1970 to 2020, ranging from subsidies to research and development (R&D) investments and trade measures. They found that trade measures such as anti-dumping actions or trade protection rarely make an industry more competitive: “It imposes high costs on downstream industries, makes few contributions to technological progress, and usually fails to turn U.S. firms into export powerhouses,” with the exception of the semiconductor industry (see figure 1). [25]

The PIIE study found that subsidies also had a very mixed effect, as “when government confines its support to a single firm to advance frontier technology, it forecloses alternative solutions that might be advocated by different scientists or business leaders.” [26] According to these scholars, it is competition within an industry, and not support for a national champion, that leads to business innovation and strength. When government and politicians choose a single firm to drive the country’s industry forward, they miss out on more efficient or productive opportunities that are now non-competitive. While these actions protect the jobs of the firm’s employees, they destroy those of domestic competitors who can no longer keep up with their state-supported rivals.

On the opposite end, the study explains that research and development actions have been the most successful, as giving the right tools to business and scientific leaders without political interference lets them act freely while also competing with each other for the best models. Additionally, these experts’ fastest-growing proposals are usually high-risk, which scares most investors, but government funding provides scientists more freedom to experiment and the security to keep projects going. Hufbauer and Jung also argue that these investments can also attract foreign research firms, which only accelerate technological development in the United States. [27]

Finally, policymakers must consider the position of U.S. allies and partners. While the European Union (EU) has been sharpening its tone both politically and commercially against China, it is not necessarily in favor of disentangling China from the Western economy. A high-ranking member of the European Parliament (MEP) with strong pro-American views made it a point in a background interview that “we are not living in the 19th-century world. Even if we have a similar geopolitical context, the economy is just not the same.” [28] The MEP argued that disentangling the U.S. and EU economies from their strategic rival would surely hurt the PRC’s growth but also devastate American and European companies, jobs, and technological development. They further argued that “our economies are too interlinked, a loss for one is a loss for all.” [29] This spirit was reciprocated by a European diplomat speaking on background: “Europe just doesn’t have that appetite for confrontation.” [30]

Conclusion

Industrial policy has many faces: geoeconomics, export controls, investment screenings, friend-shoring, and so on — and it all fits within the same frame: great power competition through technology, economics, and business. For the first time in decades, the United States is facing a challenge to the international rules-based economic order which it has created, as well as the corresponding peace and prosperity this system has secured. This challenge is not only political; it poses an existential threat to U.S. employers, companies, and industry. To maintain resilient U.S. supply chains and a competitive technological edge, policymakers must listen to Hamilton, harness the power of U.S. ingenuity and enterprise, and combine them with the federal government’s access and resources.

This reality, however, does not come without its own challenges. Choosing a national champion, as seen in the car industry case, or massively subsidizing individual firms, as seen in the PIIE study, will not do the job. To accomplish a successful industrial policy, the U.S. government must learn from the mistakes and successes of the past and use intra-firm competition as well as the knowledge of business and industry leaders to lead in this new chapter of international economics.

Eduardo Castellet Nogués ’23 served as the Treasurer of the AHS chapter at American University, where he earned a Bachelor’s degree in International Studies.

—

Notes:

[1] Uri Dadush, “Industrial Policy: A Guide for the Perplexed,” Carnegie Endowment for International Peace, 1 February 2016, https://carnegieendowment.org/2016/02/01/industrial-policy-guide-for -perplexed-pub-62660#:~:text=Sign%20up%20to%20receive%20emails,development%20of%20the%20wider%20economy.

[2] Frank C. Conahan, “Japanese Industrial Policy,” U.S. Government Accountability Office, 23 June 1982, https://www.gao.gov/assets/118810.pdf.

[3] Peter Hoskins, “China Overtakes Japan as World’s Top Car Exporter,” BBC News, 19 May 2023, https://www.bbc.com/news/business-65643064.

[4] Jason Kirby, “Canadian Taxpayers’ Secretive $2.6-Billion Gift to Chrysler,” Macleans.ca, 23 October 2018, https://www.macleans.ca/opinion/canadian-taxpayers-secretive -2-6-billion-gift-to-chrysler/#:~:text=Closing%20in%20on%20a%20decade,corporate%20deadbeat%20failed%20to%20pay.

[5] “Troubled Asset Relief Program: Continued Stewardship Needed AS Treasury Develops Strategies for Monitoring and Divesting Financial Interests in Chrysler and GM,” U.S. Government Accountability Office, 2 November 2009, https://www.gao.gov/products/gao-10-151.

[6] Judith Miller, “Carter Urges Plan to Back $1.5 Billion in Chrysler Loans Guarantee a Record Doubling of Aid Envisioned for Company Linked to Worsening Plight $1.5 Billion Chrysler Aid Backed,” The New York Times, 2 November 1979, https://www.nytimes.com/1979/11/02/archives/carter -urges-plan-to-back-15-billion-in-chrysler-loans-guarantee-a.html.

[7] Alexander Hamilton, “Alexander Hamilton’s Final Version of the Report on the Subject of Manufactures,” National Archives and Records Administration, 5 December 1791, https://founders.archives.gov/documents/Hamilton/01-10-02-0001-0007.

[8] Bruce Katz and Jessica Lee, “Alexander Hamilton’s Manufacturing Message,” Brookings Institution, 28 September 2016, https://www.brookings.edu/articles/alexander-hamiltons-manufacturing- message.

[9] Katz and Lee.

[10] “1783-1815: Business and the Economy: Overview,” Encyclopedia.com, 25 May 2023, https://www.encyclopedia.com/history/news-wires-white-papers-and-books/1783-1815-business-and-economy-overview

[11] Deepti Aggarwal, “FDI in 2021: Outbound Investment Outbound FDI in 2021: US Takes the Lead, India Sees Leap in Investment,” Investment Monitor, 22 August 2022, https://www.investmentmonitor.ai/fdi-data/fdi-in-2021-outbound-investment/#:~:text=The%20US%20maintained%20its%20leading,York%2C%20Washington%2C%20and%20Texas.

[12] Matthew Johnston, “Why the USSR Collapsed Economically,” Investopedia, 13 July 2022, https://www.investopedia.com/articles/investing/021716/why-ussr-collapsed-economically.asp.

[13] Elbridge A. Colby, The Strategy of Denial: American Defense in an Age of Great Power Conflict (New Haven, CT: Yale University Press, 2021).

[14] Flynn Murphy, “The Innovation Hubs That Drive China,” NATUREJOBS CAREER GUIDE, 2018, https://media.nature.com/original/magazine-assets/d41586-018-00538-z/d41586-018-00538-z.pdf.

[15] “New Businesses Registered (Number) – China,” The World Bank, https://data.worldbank.org/indicator/IC.BUS.NREG?locations=CN.

[16] Rob Garver, “Report: China Spends Billions of Dollars to Subsidize Favored Companies,” VOA, 24 May 2022, https://www.voanews.com/a/report-china-spends-billions-of-dollars-to-subsidize-favored-companies-/6587314.html.

[17] Zach Coleman, “US Companies in China Complain of Official Bias,” NikkeiAsia, 26 February 2019, https://asia.nikkei.com/Economy/Trade-war/US-companies-in-China-complain- of-official-bias.

[18] “Taiwan’s Dominance of the Chip Industry Makes It More Important,” The Economist, 6 May 2023, https://www.economist.com/special-report/2023/03/06/taiwans-dominance-of-the-chip-industry-makes-it-more-important.

[19] Cheng Ting-Fang and Lauly Li, “TSMC Warns Chip Market Will Stagnate in 2020 after Coronavirus,” Nikkei Asia, 16 April 2020, https://asia.nikkei.com/Business/Technology/TSMC-warns-chip-market-will-stagnate-in-2020-after-coronavirus.

[20] “Fiscal Data Explains the National Deficit,” U.S. Treasury Fiscal Data, https://fiscaldata.treasury.gov/americas-finance-guide/national-deficit/.

[21] Juliette Cubanski and Tricia Neuman, “What to Know about Medicare Spending and Financing,” KFF, 19 January 2023, https://www.kff.org/medicare/issue-brief/what-to-know-about-medicare-spending-and-financing/#:~:text=Medicare%20spending%20(net%20of%20income,and%20rising%20health%20care%20costs.

[22] “US Government Debt: % of GDP, 1969 – 2022 | CEIC Data,” CEIC, 2022, https://www.ceicdata.com/en/indicator/united-states/government-debt–of-nominal-gdp.

[23] “How Alexander Hamilton Tackled the National Debt,” Smithsonian Magazine, https://www.smithsonianmag.com/sponsored/alexander-hamilton-debt-national-bank-two-parties-1789-american-history-great-courses-plus-180962954/.

[24] James Pethokoukis, “Looking at the Pros and Cons of Industrial Policy,” American Enterprise Institute, 9 December 2021, https://www.aei.org/economics/looking-at-the-pros-and-cons-of-industrial-policy/.

[25] Euijin Jung and Gary Clyde Hufbauer, “Lessons Learned from Half a Century of US Industrial Policy,” Peterson Institute of International Economics, 30 November 2021, https://www.piie.com/blogs/realtime-economic-issues-watch/lessons-learned-half-century-us-industrial-policy.

[26] Jung and Hufbauer.

[27] Jung and Hufbauer.

[28] Member of the European Parliament and Eduardo Castellet Nogués, “State of Transatlantic Relations,” Interviews with Transatlanticists, no.1 (Fall 2022).

[29] Member of the European Parliament and Eduardo Castellet Nogués.

[30] Anonymous European diplomat and Eduardo Castellet Nogués, “State of Transatlantic Relations,” Interviews with Transatlanticists, no. 2 (Fall 2022).

Image: “Alexander Hamilton statue unveiling,” by Harris & Ewing, retrieved from https://commons.wikimedia.org/wiki/File:Alexander_Hamilton_statue_unveiling_ LCCN2016892337.tif. This work is in the public domain in the United States because it was published in the United States between 1928 and 1977, inclusive, without a copyright notice.

Charts: (Figure 1), Euijin Jung and Gary Clyde Hufbauer, “Lessons Learned from Half a Century of US Industrial Policy,” Peterson Institute of International Economics, 30 November 2021, https://www.piie.com/blogs/realtime-economic-issues-watch/les- sons-learned-half-century-us-industrial-policy.