The current epoch is characterized by both promise and peril. This is an age of relative peace, with the stabilizing influence of the American-made and -led liberal international order preventing the recurrence of great power war since 1945. [1] This peace, coupled with economic liberalization in nations like China and India, has lifted over one billion people out of extreme poverty since the end of the Cold War. [2] However, the twin challenges of sustainable development and a rising China will dominate the remainder of the twenty-first century. With the world’s population projected to reach ten billion by the end of the century and the economic and social effects of climate change increasing, the challenge of incorporating developing nations into the global economic system while implementing climate commitments will require a delicate balance. [3] Meanwhile, as China grows closer to military and economic parity with the United States, great power competition is intensifying. [4] Policies that prioritize sustainability while protecting the peace will be needed to meet the moment.

Western efforts thus far have failed to unite climate issues, great power competition, and international development. As China competes for influence globally with investments through the Belt and Road Initiative (BRI), Western-backed institutions like the World Bank have been slow to respond. In its first five years, the BRI distributed up to $600 billion in loans, exceeding the combined $490 billion from the World Bank, Inter-American Development Bank, Asian Development Bank, and African Development Bank. [5] This financial power offers China great leverage over much of the developing world. One should not assume, as during the Cold War, that competitor influence over one recalcitrant nation – say, Vietnam or Korea – will necessarily tip the global balance of power. However, a critical mass of nations dependent on BRI might alter the power balance by standing opposed to Washington’s on-and-off Asia Pivot, securing long-term energy supplies away from the U.S. Navy, and setting new global norms on international investment. [6] [7] Therefore both economic and strategic reasons encourage the West to respond.

One area of weakness for both America and China is climate finance: the distribution of financial resources for climate change mitigation and adaptation toward poorer states with greater vulnerability. [8] While U.S. President Barack Obama called for $100 billion in climate finance from developed nations by 2020, and U.S. President Joe Biden promised $11.4 billion per year from the United States by 2024, Congress in 2022 approved just $1 billion in climate finance to developing nations. [9] However, Chinese commitments are virtually nonexistent. At COP27, the most recent United Nations (UN) conference on climate, China declined to contribute toward climate aid for developing countries. [10] As for BRI, Chinese lending continues to be criticized for greenhouse gas (GHG) intensive investments. [11]

While China is wont to classify itself as a developing nation in climate finance debates, this argument is tenuous. Chinese emissions have tripled over the past three decades, and in 2019, they exceeded that of all developed nations combined. [12] Since the Industrial Revolution began, China has caused roughly 13 percent of global emissions, in contrast to 20 percent each for the United States and European Union. [13] While China’s per capita emissions continue to trail the West, this gap will decline in the future as Chinese consumption continues to increase. Domestic indicators also fail to account for foreign investment, where China is a significant contributor toward fossil fuel exploitation.

With Chinese weakness on an issue so crucial to the developing world, there is an opportunity for the West to pounce. This essay will first outline the economic and strategic rationale for greater climate finance before examining the Bridgetown Initiative as one policy option which could fulfill existing pledges. Such an approach will be essential if the twin challenges of sustainable development and strategic competition with China are to be capably addressed.

The Economic Argument: Compensating Externalities

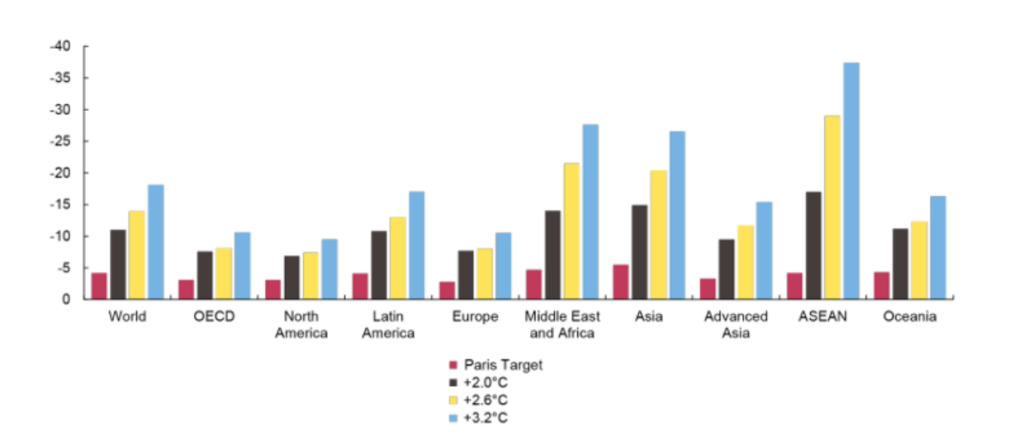

While rising sea levels, climate-induced migration, and extreme weather conditions will adversely affect the whole planet, low-income nations are more negatively affected due to greater social vulnerability to migration and economic dependence on agriculture. [14] For this reason, GHG emissions are a “global externality,” which is to say that the social cost of emissions from wealthier countries is most felt by poorer countries with much less responsibility. [15] This social cost can be measured as an economic loss to compare climate effects across regions. In GDP terms, the mid-century effects of climate change are expected to disproportionately impact developing countries at any scale of temperature increase. [16] A report from Swiss Re, the world’s second largest reinsurance company, depicts annual GDP losses at 1.5°C (the Paris Agreement target), 2.0°C, 2.6°C, and 3.2°C. [17] [18] Even if temperature increases are successfully limited to 1.5°C, annual GDP losses in Latin America, the Middle East and Africa, and Southeast Asia are predicted to be in the 5 percent range. [19] As global tipping points are reached, GDP losses rapidly increase. Losses in much of the developing world range from 10 to 15 percent of annual GDP even in the relatively benign case of 2°C (see figure 1). [20]

Climate finance, then, may correct the market failure created by the global externality by funding adaptation and mitigation efforts. Many low-income countries face a high cost of adaptation, yet they are also challenged by limited budgets and low capacity. [21] Because the private returns to adaptation and resilience are minimal, markets alone cannot effectively deliver climate finance. [22] In many cases, adaptations like infrastructure to protect coasts from sea-level rise can have significant positive externalities. [23] By providing climate finance, advanced industrial economies help compensate for the effects of their own emissions. If climate finance is used effectively, the resulting gains to social stability and economic growth in vulnerable regions may spill over to benefit developed nations as well.

The Strategic Argument: Countering China

Strategically, the BRI abets Chinese soft power and provides economic leverage. [24] Because BRI projects are explicitly tied to the Chinese state, public opinion in Africa and South Asia tends to regard China as the most important investor, even though American private investment is greater. [25] China has used investments as leverage to create favorable relations in strategic areas. Nepal has limited the arrival of Tibetan refugees, Pakistan has refused to criticize China’s mass internment of Uyghur Muslims, and Malaysia explicitly appealed for BRI aid by citing its public support for China’s South China Sea claims. [26] Without a counter-weight, China will continue to set the narrative and use its leverage toward goals contrary to American interests.

To counter BRI’s enormous lending, the West will need to maximize resources and press China’s weak points. Where China refuses to contribute toward climate finance, Western states should seize the opportunity to boost soft power and the legitimacy of the Bretton Woods institutions. The V20, a group of 58 vulnerable nations, is made up of governments deeply concerned about climate change and urgently appealed for rich countries to fulfill their climate finance obligations. [27] Possible targets for investment include Pacific Island states such as Palau, the Marshall Islands, Kiribati, Tuvalu, Vanuatu, Fiji, Samoa, and Tonga, which have become targets of Chinese militarization. [28] Four Caribbean countries – Saint Lucia, Barbados, Grenada, and Guyana – may also be apt targets for investment as China’s soft power and investment push near American shores continues. [29] These countries are climate vulnerable, strategically important, and generally well-governed, suggesting that climate finance could go a long way towards adaptation and national security. [30] [31] Since their small populations make extremely minor contributions to global emissions, climate finance should focus on adaptation and compensating damages. Larger V20 members, notably the Philippines, Vietnam, Pakistan, and Bangladesh, may be effective targets for mitigation and adaptation financing. While these countries suffer from major governance challenges, they are so strategically valuable that investment may be warranted if project corruption risks are managed. [32]

By committing to increased climate finance, the West can boost its soft power and create a new avenue for public diplomacy efforts. From Barbados to Tuvalu, the leaders of small island states have publicly chastized the West for its failure to honor past climate commitments. [33][34][35] These exhortations have reflected the concerns of citizens. Polls measuring climate change worries show that strong majorities of citizens in the Pacific Islands (82 percent), Caribbean (76 percent), Vietnam (85 percent), the Philippines (85 percent), Bangladesh (73 percent), and Pakistan (67 percent) express that they are very or somewhat worried about climate change. [36] The West must respond to these global concerns and demonstrate that its institutions can meet the needs of the moment.

If the West does not meet the “hopes and aspirations” of developing countries, then China will. [37] Many countries are open to deeper integration into the liberal international order, but America and its allies must demonstrate that such an order can work for them. [38] Climate finance is not a panacea, and the West will also need to meet development needs on infrastructure, digitalization, health, and other areas. Most countries will also continue to accept aid from China, given its economic prowess. [39] However, a positive climate finance agenda can limit dependence on China and support public messaging efforts on an issue many find dear. For developing small island states, the goal should be to prevent them from becoming like the Solomon Islands, which opened the door to Chinese military bases in return for $730 million of aid. [40] For larger partners in Asia, the priority should be strong integration into the liberal order. Climate finance can and should be part of a multifaceted approach to make these goals a reality.

Policy Recommendation: The Bridgetown Initiative

Between the Bridgetown Initiative, the new Bridgetown Initiative 2.0, the ideas discussed at COP27, and the Summit for a Global Financing Pact hosted in June 2023, climate finance proposals are proliferating. [41][42] To frame the conversation, policymakers’ goals should be to stimulate private investment, support adaptation, and fund loss and damage, in that order. The original Bridgetown Initiative, which addresses all three goals, should be on the minds of leaders as COP28 approaches in November. Introduced by Barbados Prime Minister Mia Mottley alongside Avinash Persaud, a former senior banker and currently Special Envoy to PM Mottley, policymakers should strongly consider their proposals to keep promises made at COP27.

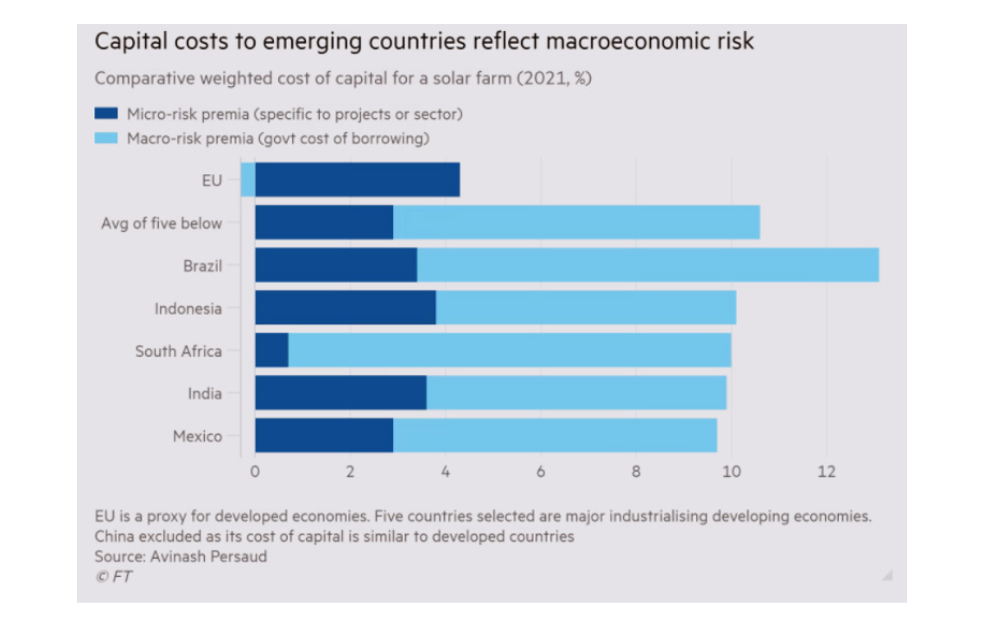

With massive investment needed for climate mitigation in developing countries, it is unrealistic to expect foreign aid to play a leading role. [43] Unfortunately, just 14 percent of clean energy is privately funded in developing countries, a stark contrast with 81 percent in developed economies. [44] Even for identical projects, the cost of capital in developing countries is much higher because of the systemic risk of currency volatility, asset expropriation, and sovereign debt crises (see figure 2). [45]

In response, Persaud calls for a Global Climate Mitigation Trust seeded with $500 billion of International Monetary Fund (IMF) Special Drawing Rights (SDRs). [46] With $100 billion in SDRs recently committed at a summit in Paris, there will be an opportunity to monitor effectiveness for a few years and commit additional monies as needed. [47]

While SDRs are not currency or a claim on the IMF, they represent a potential claim on freely usable currencies. That is, SDRs can be exchanged with other freely usable currencies (the U.S. dollar, the Euro, the Chinese renminbi, the Japanese yen, and the British pound sterling) at concessional interest rates of 2.4 percent. SDRs for the Global Climate Mitigation Trust would fund specific projects vetted for their environmental impact. [48] With SDRs seeded into the trust, Persaud suggests that the IMF then convert these into tangible money for climate projects. [49]. Crucially, the IMF would issue loans for private projects rather than to governments. [50] Macroeconomic risk for a private project, for instance, could be offset by an IMF loan at 2.4 percent rather than around 10 percent. This change would generate an estimated $2.5 to 5 trillion in follow-on private investment. [51] In a separate paper, Persaud argues that the risk premium in emerging markets is systemically overstated, suggesting that the social cost of subsidized loans is much less than the price tag would suggest. [52] [53] While evaluating this claim is beyond the scope of this essay, relevant experts should vigorously debate this important detail in advance of COP28.

While private projects are essential to mitigation, climate adaptation is needed in areas where the effects of temperature rises are already being felt. Unfortunately, over 90 percent of climate finance currently goes towards mitigation. [54] Persaud suggests that multilateral development banks should substantially scale concessional finance – loans on better terms than commercially available – for climate adaptation and resilience. [55] Because measures to protect against sea level rise, salinity intrusion, and floods, as well as resilient infrastructure and water conservation, do not have a rate of return, they will not be addressed by private capital even with the Global Climate Mitigation Trust. [56] While the World Bank currently only offers concessional financing to countries with an annual GDP of under $1,253 per capita, there may be need to expand the pie to include middle-income countries vulnerable to climate impacts. [57] To remain consistent with the World Bank’s mission to support the poorest countries, such a change should be strictly limited to climate finance. Nonetheless, there is a major need for public investments in adaptation now to reduce costs from damages later.

Finally, Persaud advocates loss and damage funding for climate disasters. Existing measures in this area, such as the “Global Shield” to insure against climate disaster, have proven unsatisfactory. [58] The Global Shield devises insurance against climate damage so that losses are more evenly spread. [59] Unfortunately, this policy is likely to suffer from an adverse selection problem, where only those nations most likely to experience climate damage opt into insurance, driving up the premiums. Because it is increasingly clear which nations will suffer the most from climate loss and damage, states that are less vulnerable will opt out of climate insurance. [60] Private insurance markets function effectively where potential loss is uncertain and risks can be spread out over time. This is not the case with climate change, so an alternative approach is needed.

As an alternative, Persaud proposes the creation of natural disaster and pandemic clauses for all sovereign debt instruments. If an independent agency were to declare a natural disaster, then debt payments and would be suspended for two years with maturity postponed at the original interest rate. [62] For nations seeking financial relief after disaster, this approach would provide immediate liquidity without the need for complex debt negotiations. [63] [64] No insurance mechanism is required, and affected nations are directly compensated for their losses. Establishing an automatic funding mechanism may prove more palatable than continually negotiating aid on a case-by-case basis.

The Bridgetown Initiative, if adopted, would substantially increase the scope of climate finance from Western-backed institutions to developing nations. Faced with the twin challenges of sustainable development and strategic competition, the West must demonstrate that the liberal international order can work for developing countries in the 21st century. Increasing climate finance, with the Bridgetown Initiative as a guide, is an important component of these efforts. The proposal carries both economic and strategic potential and therefore ought to be seriously considered as COP28 nears.

Ty Rossow ’23 served as the President of the AHS chapter at Baylor University, where he earned a Bachelor’s degree in Political Science and Economics.

—

Notes:

[1] Hal Brands, American Grand Strategy and the Liberal Order: Continuity, Change, and Options for the Future, PE-209-OSD (Santa Monica, CA: RAND Corporation, 2016), 1-3, https://www.rand.org/pubs/perspectives/PE209.html.

[2] “Decline of Global Extreme Poverty Continues but Has Slowed: World Bank,” World Bank, 19 September 2018, https://www.worldbank.org/en/news/press-release/2018/09/19/decline-of-global-extreme-poverty-continues-but-has-slowed-world-bank.

[3] “A commitment to a sustainable future,” Monash University, 27 September 2018, https://lens.monash.edu/2018/09/27/1360970/a-commitment-to-a-sustainable-future.

[4] Rush Doshi, The Long Game: China’s Strategy to Displace American Order (New York, NY: Oxford University Press, 2021), 3-6.

[5] Adva Saldinger, “China’s Belt & Road Initiative out-lends MDBs, sees itself as ‘global public good’,” Devex, 23 October 2019, https://www.devex.com/news/china-s-belt-road-initiative-out-lends-mdbs-sees-itself-as-global-public-good-95873.

[6] Andrew Chatzky and James McBride, “China’s Massive Belt and Road Initiative,” Council on Foreign Relations, 28 January 2020, https://www.cfr.org/backgrounder/chinas-massive-belt-and-road-initiative.

[7] Conor M. Savoy, “The Global Development Finance Agenda and the G7 Hiroshima Summit,” Center for Strategic and International Studies, 3 May 2023, https://www.csis.org/analysis/global-development-finance-agenda-and-g7-hiroshima-summit.

[8] “Introduction to Climate Finance,” United Nations Framework Convention on Climate Change, https://unfccc.int/topics/introduction-to-climate-finance#:~:text=What%20is%20climate%20finance%3F,that%20will%20address%20climate%20change.

[9] Somini Sengupta, “The U.S. has made big promises. Where’s the money?” New York Times, 15 March 2022, https://www.nytimes.com/2022/03/15/climate/united-states-climate-pledges.html.

[10] Chermaine Lee, “China Says It Won’t Pay Into Climate Fund for Developing Countries,” Voice of America, 10 November 2022, https://www.voanews.com/a/china-says-it-won-t-pay-into-climate-fund-for-developing-countries/6828347.html.

[11] Rishikesh Ram Bhandary et al., “Demanding development: The political economy of climate finance and overseas investments from China,” Energy Research & Social Science 93 (November 2022): 3, https://doi.org/10.1016/j.erss.2022.102816.

[12] “Report: China emissions exceed all developed nations combined,” BBC, 7 May 2021, https://www.bbc.com/news/world-asia-57018837.

[13] Lee.

[14] Landry Signé and Ahmadou Aly Mbaye, Renewing Global Climate Change Action For Fragile And Developing Countries, Working Paper 179 (Washington, DC: Brookings Institution, 2022), 4-6, https://www.brookings.edu/wp-content/uploads/2022/11/NOV-2022-Signe_Mbaye_FINAL-1.pdf.

[15] William D. Nordhaus, “Climate change: The Ultimate Challenge for Economics,” Nobel Prize Lecture (New Haven, CT: Yale University, December 2018), 440, https://www.nobelprize.org/uploads/2018/10/nordhaus-lecture.pdf.

[16] Signé and Mbaye, 7.

[17] “The economics of climate change: No action not an option,” Swiss Re Institute, April 2021, 2, https://www.swissre.com/dam/jcr:e73ee7c3-7f83-4c17-a2b8-8ef23a8d3312/swiss-re-institute-expertise-publication-economics-of-climate-change.pdf.

[18] “Top 50 Global Reinsurance Groups,” Reinsurance News, https://www.reinsurancene.ws/top-50-reinsurance-groups/.

[19] “Trade and Development Report 2021,” United Nations Conference on Trade and Development (UNCTAD), 2021, 87, https://unctad.org/system/files/official-document/tdr2021_part2_en.pdf.

[20] Graph generated by UNCTAD using Swiss Re data.

[21] Matthieu Bellon and Emanuele Massetti, “Economic Principles for Integrating Adaptation to Climate Change into Fiscal Policy,” International Monetary Fund Staff Climate Note 2022/001 (March 2022): 4, https://www.imf.org/en/Publications/staff-climate-notes/Issues/2022/03/10/Economic-Principles-for-Integrating-Adaptation-to-Climate-Change-into-Fiscal-Policy-464314.

[22] Michael Franczak, “For Effective Climate Finance, Developing Countries and MDBs Lead by Example,” Kleinman Center for Energy Policy, 10 November 2021, https://kleinmanenergy.upenn.edu/news-insights/for-effective-climate-finance-developing-countries-and-mdbs-lead-by-example/.

[23] Bellon and Massetti, 3-4.

[24] Jennifer Hillman and David Sacks, China’s Belt and Road: Implications for the United States, Independent Task Force Report 79 (New York, NY: Council on Foreign Relations, 2021), https://www.cfr.org/report/chinas-belt-and-road-implications-for-the-ed-states/download/pdf/2021-04/TFR%20%2379_China%27s%20Belt%20and%20Road_Implications%20for%20the%20United%20States_FINAL.pdf.

[25] Hillman and Sacks.

[26] Hillman and Sacks.

[27] Fiona Harvey, “Rich countries must urgently help poor nations hit by climate crisis, says V20,” The Guardian, 17 October 2022, https://www.theguardian.com/environment/2022/oct/17/rich-countries-must-urgently-help-poor-nations-hit-by-climate-crisis-says-v20.

[28] Brian Harding and Camilla Pohle-Anderson, “China’s Search for a Permanent Military Presence in the Pacific Islands,” United States Institute of Peace, 21 July 2022, https://www.usip.org/publications/2022/07/chinas-search-permanent-military-presence-pacific-islands.

[29] “China Regional Snapshot: The Caribbean,” House Foreign Affairs Committee, 11 November 2022, https://foreignaffairs.house.gov/china-snapshot-project-the-caribbean/.

[30] “Global Freedom Scores,” Freedom House, 2023, https://freedomhouse.org/countries/freedom-world/scores.

[31] “Corruption Perceptions Index,” Transparency International, 2022, https://www.transparency.org/en/cpi/2022/.

[32] “Corruption Perceptions Index.”

[33] Lucy Handley, “Pacific island minister films climate speech knee-deep in the ocean,” CNBC, 8 November 2021, https://www.cnbc.com/2021/11/08/tuvalu-minister-gives-cop26-speech-knee-deep-in-the-ocean-to-highlight-rising-sea-levels.html.

[34] David Gelles, “A Powerful Climate Leader From a Small Island Nation,” New York Times, 14 November 2022, https://www.nytimes.com/2022/12/14/world/americas/mia-mottley-climate-change-barbados.html.

[35] Jintamas Saksornchai, “Pacific Island leaders say rich countries are not doing enough to control climate change,” Associated Press, 15 May 2023, https://apnews.com/article/pacific-island-leader-climate-change-b7d1a524eb25cc94449158e702919512.

[36] Anthony Leiserowitz et al., “International Public Opinion on Climate Change,” Yale Program on Climate Change Communication and Data for Good at Meta, 2022, https://climatecommunication.yale.edu/wp-content/uploads/2022/06/international-public-opinion-on-climate-change-2022a.pdf.

[37] Dan Runde, “The New Cold War,” Deseret News, 16 May 2023, https://www.deseret.com/2023/5/16/23681265/new-cold-war-moscow-beijing.

[38] Runde.

[39] Gahyun Helen You and Miranda Wilson, “Climate Finance and Geostrategic Interests in the Pacific,” Foreign Policy, 1 August 2022, https://foreignpolicy.com/2022/08/01/climate-change-pacific-islands-security/?fbclid=IwAR2dHdTpmuuV7P-elQRdkhwwCFkQVl_8pU-0ib8iq3QgZMXnJMw4HxxazC0.

[40] You and Wilson.

[41] “Bridgetown 2.0,” April 2023, https://assets.bwbx.io/documents/users/iqjWHBFdfxIU/rgUFt2H4YNsw/v0.

[42] “Chair’s summary of discussions at the Summit on a New Global Financing Pact,” June 2023, https://nouveaupactefinancier.org/pdf/chairs-summary-of-discussions.pdf.

[43] Avinash Persaud, “Unblocking the green transformation in developing countries with a partial foreign exchange guarantee,” Climate Policy Initiative, 7 June 2023, https://www.climatepolicyinitiative.org/wp-content/uploads/2023/06/An-FX-Guarantee-Mechanism-for-the-Green-Transformation-in-Developing-Countries.pdf.

[44] Avinash Persaud, “Unblocking the green transformation.”

[45] Martin Wolf, “The green transition won’t happen without financing for developing countries,” Financial Times, 20 June 2023, https://www.ft.com/content/770aadbb-1583-40ae-b072-9ef44c27cc15.

[46] Avinash Persaud, “Breaking the Deadlock on Climate: The Bridgetown Initiative,” Groupe d’études géopolitiques, November 2022, https://geopolitique.eu/en/articles/breaking-the-deadlock-on-climate-the-bridgetown-initiative/.

[47] “IMF has hit $100 billion target of special drawing rights for vulnerable countries, Georgieva says,” Reuters, 22 June 22, 2023, https://www.reuters.com/markets/imf-has-hit-100-bln-target-sdrs-vulnerable-countries-georgieva-2023-06-22/.

[48] Persaud, “Breaking the Deadlock on Climate.”

[49] Persaud, “Breaking the Deadlock on Climate.”

[50] Persaud, “Breaking the Deadlock on Climate.”

[51] Avinash Persaud, “Opinion: The Bridgetown Initiative,” UN Climate Summit, 15 November 2022, https://unclimatesummit.org/opinion-the-bridgetown-initiative/.

[52] Persaud, “Unblocking the green transformation.”

[53] Paulo Guimaraes and Tim Koller, “Don’t overthink your approach to valuation in emerging markets,” McKinsey & Company, 15 July 2021, https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/dont-overthink-your-approach-to-valuation-in-emerging-markets.

[54] Barbara Buchner et al., “Global Landscape of Climate Finance 2021,” Climate Policy Initiative, 14 December 2021, https://www.climatepolicyinitiative.org/publication/global-landscape-of-climate-finance-2021/.

[55] Persaud, “Breaking the Deadlock on Climate.”

[56] Persaud, “Breaking the Deadlock on Climate.”

[57] Persaud, “Breaking the Deadlock on Climate.”

[58] Brad Plumer et al., “U.N. Climate Talks End With a Deal to Pay Poor Nations for Damage,” New York Times, 20 November 2022, https://www.nytimes.com/2022/11/20/climate/un-climate-cop27-loss-damage.html.

[59] Michel M. Liès, “The Global Shield against Climate Risks: From Ambition to Reality,” Zurich Insurance Group, 17 November 2022, https://www.zurich.com/en/knowledge/topics/climate-change/the-global-shield-against-climate-risks-from-ambition-to-reality.

[60] Liès.

[61] Persaud, “Breaking the Deadlock on Climate.”

[62] Persaud, “Breaking the Deadlock on Climate.”

[63] Persaud, “Breaking the Deadlock on Climate.”

Image: “ISS-48 Towering cumulonimbus and other clouds over the Earth,” by NASA, retrieved from https://commons.wikimedia.org/wiki/File:ISS-48_Towering_cumulonim- bus_and_other_clouds_over_the_Earth_(2).jpg. This file is in the public domain in the United States because it was created by the Image Science & Analysis Laboratory, of the NASA Johnson Space Center. NASA copyright policy states that “NASA material is not protected by copyright unless noted.” (NASA media use guidelines or Conditions of Use of Astronaut Photographs). Photo source: ISS048-E-046923.

Charts: (Figure 1), Landry Signé and Ahmadou Aly Mbaye, Renewing Global Climate Change Action For Fragile And Developing Countries, Working Paper #179 (Washington, DC: Brookings Institution, 2022), 4-6, https://www.brookings.edu/wp-content/up- loads/2022/11/NOV-2022-Signe_Mbaye_FINAL-1.pdf. (Figure 2), Avinash Persaud, “Unblocking the green transformation in developing countries with a partial foreign exchange guarantee,” Climate Policy Initiative, 7 June 2023, https://www.climatepolicyinitiative.org/wp-content/uploads/2023/06/An-FX-Guarantee-Mechanism-for-the-Green-Transformation-in-Developing-Countries.pdf.